RC Digital Technologies Pvt. Ltd.

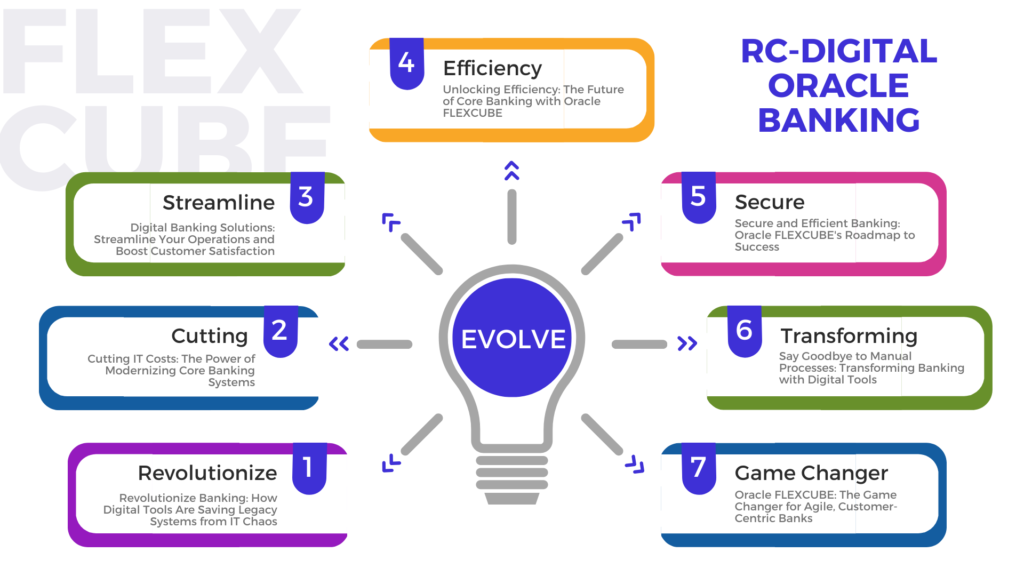

RC-Digital Oracle FlexCube & Digital Payments Solutions

Our Consulting solutions stack covers key functional areas

You can avail of a range of core banking services, including design and development deployment and optimization, upgrades, and support for any core banking systems and functional modules. We often work with legacy banking systems that banks are looking to upgrade or modify. The old systems cause excessive IT expenditures due to manual processing, inefficient processing, inefficient timing to market, lack of personalization, and lack of integrations.

Digital banking tools can address these issues. Ensure your app is replaced by an industry-opted, standard solution that automates processing, adequate storage of data and analysis, top-quality customer assistance, and omnichannel delivery. Additionally, the latest core banking and financial services offer 360-degree customer views, regulatory compliance, and secure IT Security measures.

We opt for Oracle FLEXCUBE Universal Banking Solutions that are designed to modernize Core Banking Systems and flag off the banks’ journey to being more agile, efficient and customer-centric.

Our Digital Banking Solutions

Our Banking Analytics and Regulatory Compliance Solutions

Banking analytics is a vital tool for ensuring regulatory compliance in the financial industry. By using analytics and machine learning, banks and other financial institutions can analyze large amounts of data and identify potential risks and compliance issues. This can help them to proactively address potential compliance issues and meet regulatory requirements.

RC-Digital banking analytics and regulatory compliance services are designed to help banks and financial institutions get a better understanding of their data and identify any potential compliance issues. These services can help banks to improve their risk management practices and ensure that they are meeting all relevant regulatory requirements.

OFSAA, or Oracle Financial Services Analytical Applications, enables banks to measure and meet risk-adjusted performance objectives, build a transparent risk management approach, optimize compliance and regulation costs, and deliver customer-plus business insights.

What are the advantages of Banking Analytics and Regulatory Compliance Solutions?

The advantages of using banking analytics and regulatory compliance solutions in the financial industry include:

- Improved decision making : By using analytics to analyze data, banks can gain insights that can inform their decision-making processes. This can help them to make more informed and strategic decisions about their business operations.

- Enhanced risk management : Banking analytics can help banks to identify potential risks and proactively address them, improving their risk management practices. Regulatory compliance solutions can help banks to meet regulatory requirements and reduce the risk of non- compliance.

- Increased efficiency : Analytics can be used to streamline processes and identify inefficiencies, leading to increased efficiency. Regulatory compliance solutions can help banks to automate compliance processes, reducing the need for manual intervention.

- Better customer service:By using analytics to analyze customer data, banks can gain insights into customer preferences and needs, and use this information to improve their customer service. This can help to build customer loyalty and drive business growth.

- Cost savings : By using analytics to identify in efficiencies and automate processes, banks can reduce their operational costs. Regulatory compliance solutions can also help banks to reduce their compliance costs by automating compliance processes and reducing the risk of non-compliance.

Overall, banking analytics and regulatory compliance solutions can provide a range of advantages to financial institutions, including improved decision making, enhanced risk management, increased efficiency, better customer service, and cost savings.

What is OFSAA in banking?

OFSAA (Oracle Financial Services Analytical Applications) is a suite of analytical applications and tools developed by Oracle that is used by banks and other financial institutions to manage their data and perform financial analysis. OFSAA includes a range of applications and tools for tasks such as data management, risk management, financial reporting, and compliance.

OFSAA is designed to help financial institutions to extract insights from their data and make informed decisions about their business operations. It includes a range of features and capabilities, such as data integration, data modeling, analytics, and reporting, that can be used to analyze and visualize data from multiple sources. OFSAA is often used in conjunction with other financial systems and applications,

such as enterprise resource planning (ERP) systems and customer relationship management (CRM) systems, to provide a comprehensive view of an organization’s data and operations.

Our ERP Solutions Offerings

As a banking institution, you need to effectively manage and integrate all aspects of your business to stay competitive in today’s market. That’s where Enterprise Resource Planning (ERP) systems come in.

An ERP system provides a centralized platform for managing financials, human resources, supply chain, and customer relationship management, allowing you to streamline your operations and improve efficiency. With real-time data and analytics at your fingertips, you can make more informed decisions and respond more quickly to changing market conditions. Security is a top priority in the banking industry and an ERP system offers enhanced security features such as role-based access controls, encryption, and data backup, which helps protect sensitive customer data and financial information. This also enables to better manage customer relationships and provide more personalized services, which can improve customer satisfaction and loyalty.

Investing in ERP solutions by RC-Digital is a smart decision that can help you stay ahead of the competition and provide better services to your customers.

Solutions delivered towards:

Supply Chain Management

Human Capital Management

Enterprise Performance Management

Project Portfolio Management

Our Offerings

A study infrastructure forms the skeleton on which the banks engineer the rest of the systems. Our Infrastructure services include

Managed Services

System Integration services

RC-Digital Flexcube range of services

Implementaion

Customizaion

Support

System integration

Migration

FLEXCUBE’s Open, Cloud-ready and Agile platform helps banks transform new products and service development, bundling with their own or those of partners and pricing them competitively and do so with speed. New functionality has been built on a micro services-based architecture. A microservices architecture offers banks extremely high levels of architectural flexibility and adaptability in defining and deploying service components as per its requirements.

OBDX helps Banks enhance Digital Customer journeys, deliver seamless experiences and embrace Open Banking

Oracle Banking Digital Experience is a digital banking platform that enables banks to progressively transform into a digital banking powerhouse. The solution is designed to completely service a customer’s financial needs at any point in their lifecycle through a digital channel of their choosing. Banks can offer their retail and corporate customers AI and ML-powered highly intuitive, context-aware solutions which simplify their daily routine.

Oracle Banking Digital Experience (OBDX) brings enterprise-class, open, cloud-ready, scalable, digital banking solutions.

RC-Digital Digitally implemented OBDX (Oracle Banking Digital Experience) for Digital

Only Banks, Challenger Banks apart from implementations across

Digital, Branch and other channels. Our clients have experienced 350-500% growth

in Digital transactions volumes post-implementation of OBDX solution components.

Elevate Digital Banking Experiences with Oracle Cloud

A robust Digital platform delivering true Omni-Channel experience to Customer across all Channels

A comprehensive digital banking suite that encompasses Retail, SME, Corporate, and Islamic business lines

Open Banking ready and highly extensible solution capable of integrating into bank’s internal landscape. Additionally, it can extend to support Bank’s ecosystem partners via Banking API increasing monetization

Retail Digital Banking capabilities affords seamless banking experience via Personalized and contextual dashboards, Smart Navigation and Conversational Banking support. It brings Full Spectrum Retail Banking servicing capabilities enabling customer to originate and transact digitally.

Corporate Digital Banking capabilities supports SME, Mid-market and Large Corporate customer needs. It encompasses Cash Management, Liquidity Management, Virtual Accounts, Trade Finance, Supply Chain Finance, Corporate Lending and Credit facilities